How to Successfully Navigate Financial Stress

For many, financial stress is an all-consuming anxiety. The specter of debt, late payment, and seizure of assets lingers over a growing number of individuals and families around the world. Surveys show that nearly three out of four American adults reported feeling stressed about money during the past month, while around a quarter of respondents said that they experienced “extreme stress.” Parents of young children, as well as younger generations (Millennials and Gen Xers), are especially susceptible to feeling anxious over their income, debt, and financial stability.

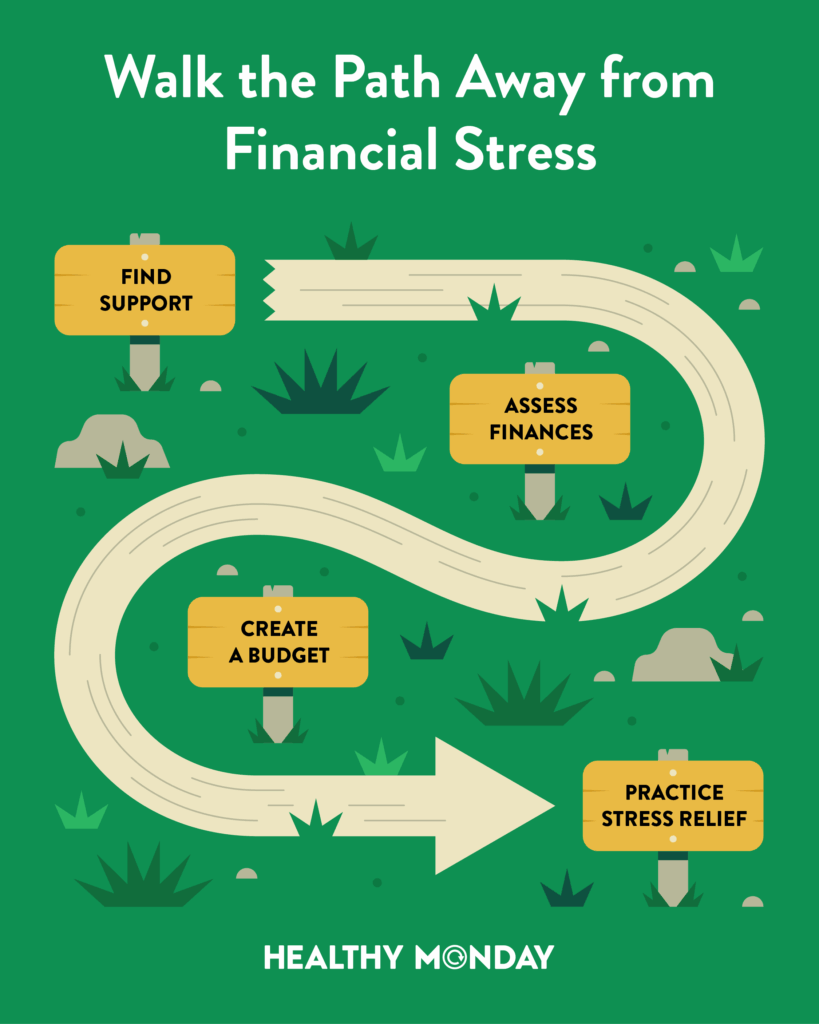

Financial problems can be painful, challenging, and demoralizing, but handling them emotionally or haphazardly will only make them worse. That’s why it’s crucial to approach financial stress the same way you would approach other emotionally challenging situations. By gaining a better understanding of financial management and learning a few key stress reduction techniques, a person can develop the clarity, confidence, and knowledge necessary to overcome this challenge.

Find Support

Sharing something deeply personal is never easy, but keeping it all inside can be even more destructive. If you’re feeling embarrassed or ashamed, consider discussing the matter with an online community, a financial advisor, or a support group. You’ll quickly learn that you’re not alone, and that many others are in a similar situation. Once comfortable, try talking with a trusted friend or family member. Not only will this relieve some internal tension, but it may also yield some valuable insight or advice, or simply help put things in perspective.

Understand Your Current Financial Situation

When facing financial difficulties, the most productive step is to assess your current financial situation. Don’t ignore bills or creditors; this will only compound the problems. Instead, take a deep dive into your financials, which may feel intimidating at first, but will help you comprehend and manage your situation in the long run. Have a document on your computer that lists your debts, spending, and income sources. Try to cut back on unnecessary expenses, like fancy morning coffee, pricey lunch, or nonessential subscriptions (hello, streaming services), and avoid scenarios that may compel you to spend money unwisely.

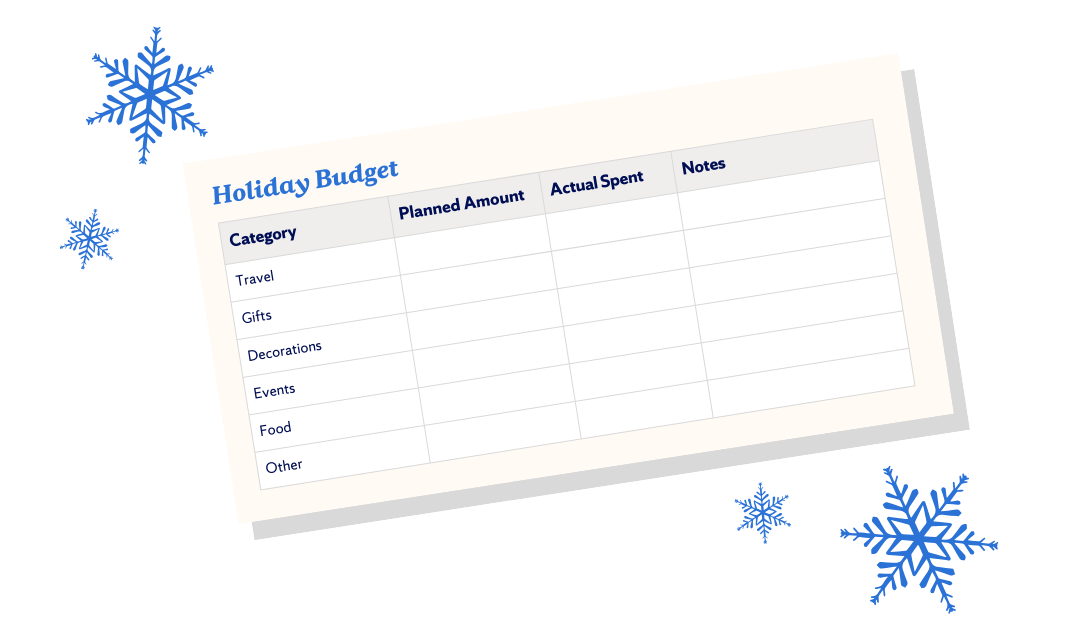

Create a Monthly Budget

The first step to creating a budget is to calculate your net income (take-home pay after taxes). Next, track and organize your expenses. Review your monthly bank or credit card statement to identify fixed costs (such as rent, mortgage, and car payments), variable costs (which change month-to-month), and any additional spending (on leisure, dining, entertainment, or subscriptions). Think of this process like spring cleaning or a yard sale. The more you cut, the more money you will be able to save (and spend) later on. Defining a budget helps offer perspective and allows you to identify the things that truly matter to you.

Practice Stress Management Techniques

A clear mind is essential when dealing with complex or challenging scenarios. Use different stress management techniques, like deep breathing practices (4-7-8 technique or belly breathing), yoga, visualization techniques (picture yourself debt-free), or positive affirmations, such as “I am strong, resilient, and can overcome challenges” or “I am enough, just as I am,” to help reframe negative thoughts and alleviate tension throughout the day. Regular sleep, a nutritious diet, and routine physical activity are all equally important to maintaining a positive outlook during challenging times.

The Takeaway

Financial stressors are always difficult and upsetting, but by talking with others, finding support, enlisting the help of professional financial advisors, and maintaining a clear mind and healthy body, you will be best equipped to weather the storm. It may feel like you’re alone, but keep in mind that this issue affects people of all ages, backgrounds, and income levels. Take the next step with our free Financial Stress Relief Workbook, a practical tool to help you stay organized, manage stress, and find financial peace.